Chelsea - Financial Fair Play?

Andy Trobe explains Chelsea's financial shenanigans and the lessons to learn for NUFC

Last year, I wrote an article on Chelsea’s “creativity” in complying with the Premier League’s Profitability & Sustainability Rules (PSR). It was hard not to have a sneaking admiration for the sheer audacity of their finance team.

I can just imagine the crisis meeting called by an anxious Chelsea owner, Todd Boehly, with his executive team to discuss which players they were going to have to sell to stay within the 3-year allowable loss (£105m). Probably similar to the one that Newcastle had last June before being forced to sell Anderson and Minteh.

And then up pops Colin from Accounts:

Colin - “There might be another way, Todd”

Todd – “Go on”

Colin – “This might seem a bit leftfield but I think we can sell our women’s team”

Todd – “Eh?! We’ve got a women’s team? Who would we sell it to?”

Colin – “Em, ourselves”

Todd – “Really?! How much for?”

Colin – “How much do we need to comply with PSR?”

Todd – “We’re fucked. We need a fortune”

Colin – “Will £200m cover it?”

Todd – “Will the Premier League swallow that?”

Colin – “They’d have to be spectacularly clueless to do so”

Todd – “That’s a given. Go for it”.

Chelsea were in fact taking advantage of a PSR loophole that allows clubs to sell assets to their sister companies for a profit. That profit can then be used to offset allowable PSR losses. The Premier League clubs voted last June against closing this loophole.

As well as £200m from the sale of Chelsea Women to their sister company Blueco 22 Midco Ltd, Chelsea also registered income of £76.5m from the sale of two hotels to another sister company in June 2023.

We know that Chelsea were compliant for the PSR three-year monitoring period ending 2023-24, as the Premier League has confirmed that no clubs were in breach.

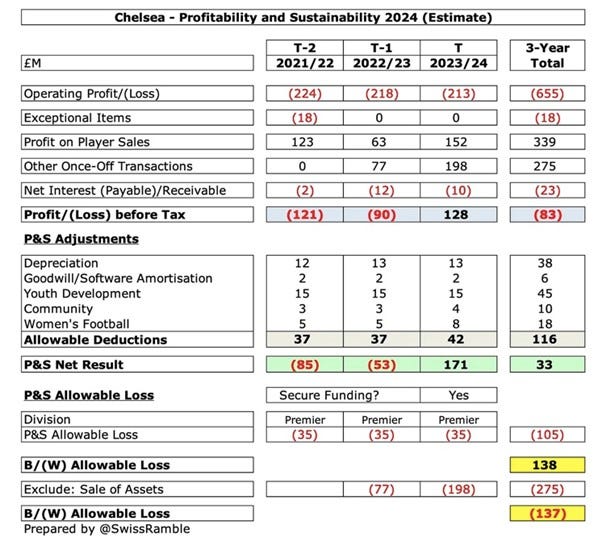

The Football Finance blogger, Swiss Ramble (credit to him for the charts in this article - follow him on Substack), calculates that Chelsea comfortably complied with the rules as a result of their intra-company sales. He estimates that they made a profit of £33m over the three-year monitoring period. However, without the income declared from those sales, Chelsea would have had a total 3-year loss of approximately £242m considerably breaching the £105m allowable loss. Bonus for Colin from Accounts.

Whilst Chelsea have complied with the Premier League financial rules, unfortunately for them, UEFA’s rules are not quite so forgiving. They do not allow clubs to declare income from selling assets to sister companies.

We noted earlier that without the income from the sales of the women’s team and hotels, Chelsea would have made losses of about £242m. This is a huge breach of the UEFA limits (which are stricter than the Premier League’s). Not even Colin from Accounts can spin his way out of this one.

The Sunday Times has reported that Chelsea are now in talks with UEFA over a settlement which is likely to involve the club paying a financial penalty and agreeing to a spending plan for the next three seasons. That plan could include the threat of stiffer sanctions, such as exclusion from European competition for a season, if they breach their limits again.

What does this mean for Newcastle?

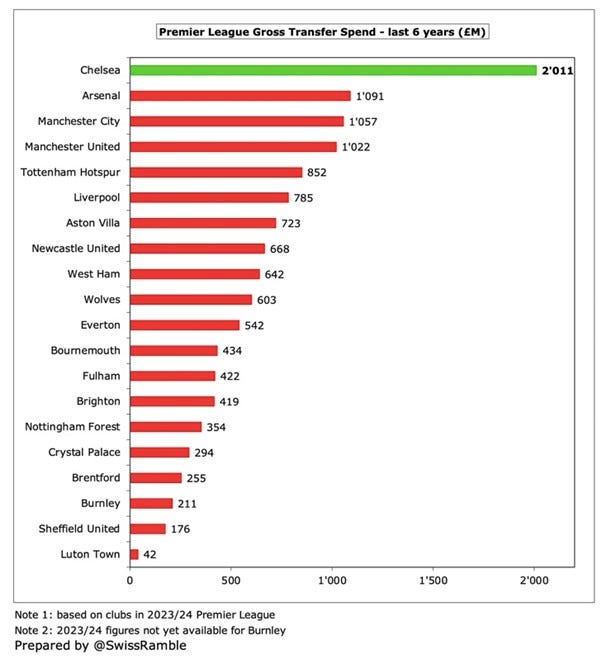

I think it’s a warning. Chelsea are in the financial position that they are now as a result of chasing success. They have spent eye-watering sums on transfer fees and wages over the last 6 years in a desperate attempt to re-create the Abramovich era. They still seem no closer to doing so.

But Chelsea’s financial problems haven’t gone away. Their operating losses over the last two seasons (before player sales and their shady intra company sales) have been north of £200m. It’s likely to be the same in 24/25.

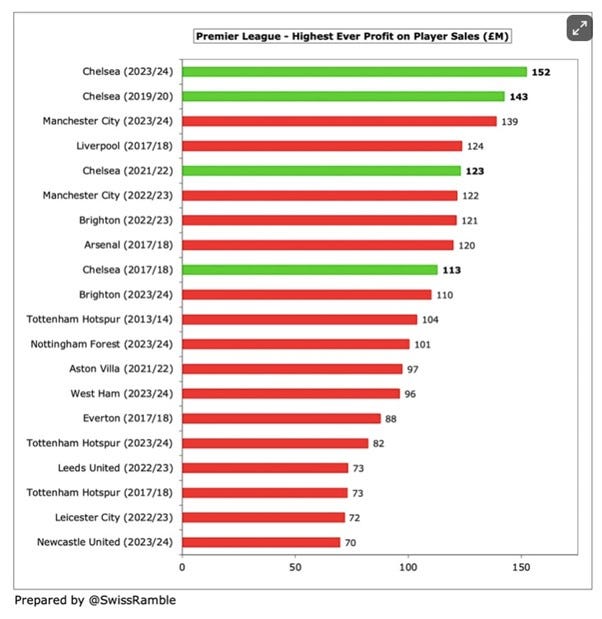

That means they will likely be calling upon the services of Colin from Accounts again. But you can only sell your women’s team, or your hotels, once. Unless Chelsea have other assets of similar value, this particular avenue of revenue will disappear. They will need to rely on more traditional sources of income, or cost cutting, to dig them out of this hole. To be fair to Chelsea, they’re particularly good at selling players from their 354 man squad!

Newcastle face similar problems as Chelsea, albeit on a lesser scale. Their operating losses (before player sales) for each of the last two years have been about £70m (22/23 and 23/24). This triggered the last-minute panic in June 2024 to sell Anderson and Minteh to enable them to comply with PSR.

How can we avoid similar panic in the future and still compete for, and retain, the best players possible for the club? Newcastle haven’t got any hotels to sell to themselves. And not even our very own Colin from Accounts would value our women’s team at 2/3rds of the £300m that NUFC was sold for in 2021.

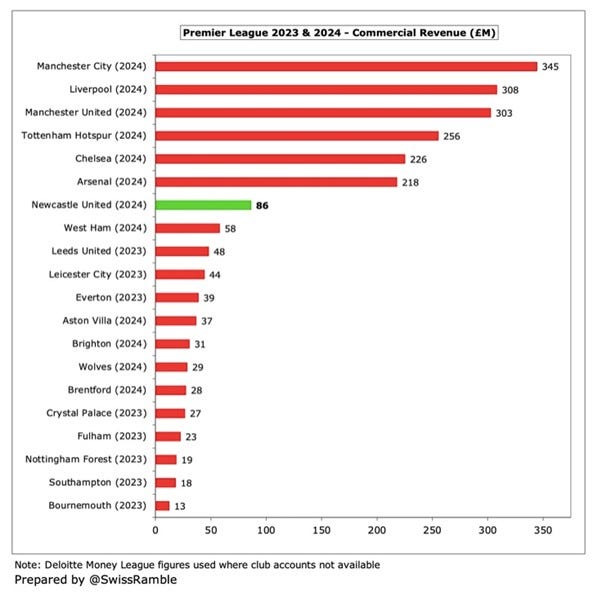

The sales of Almirón and Kelly will help but we don’t yet have a conveyor belt of players to sell like Chelsea. The only sustainable, long-term solution for the club is a theme I constantly return to - ramping up our commercial deals.

Newcastle are still miles behind the “big six” on their commercial revenue. PL rules (currently being challenged by Man City) dictate that associated party transactions (APTs) must be “fair value”. However, the rules also state that if the Premier League think that APTs are artificially inflated then it is up to them to prove it (previously the onus was on the club to prove the deal was fair market value). We’re now a high flying, trophy winning, Champions League qualifying Premier League club. If the PL are to accept that Chelsea’s womens team is worth £200m, would they challenge NUFC signing a multi-million sponsorship deal with Armaco?

I’d suggest the time is right to test the resolve of the Premier League.

Andy Trobe

I feel it’s tardy that almost four years down the line NUFC haven’t got Saudi Air sponsoring more things we can stick a label on, such as the dugouts or Jason Tindall’s toiletry bag, obviously for huge sums of dosh…….

Hopefully, Karma will continue to see Chelsea's gaming the system tactics fail to bear fruit. But when you see results like the Fulham one on Saturday, you do wonder if crime will eventually pay. As for the club and its owners it does look like a holding pattern has developed and you can't help but wonder what the current attitude towards fully tapping into the clubs potential is ? Are they just being ultra cautious or are their feet getting a little cold? I have no doubt they will continue to allow every single available penny within PSR limits to go towards team building but as for the grand developments essential to move the club up the levels i think we could all do with some reassuring statements of commitment.